A major rumor has recently surfaced in the tech world: Nvidia might outsource the production of its gaming GPUs to Intel’s foundry. If this potential partnership materializes, it could mark a significant breakthrough for Intel’s foundry business. UBS analyst Timothy Arcuri noted that securing an order from Nvidia, a global leader in fabless chip design, could be a pivotal turning point for Intel’s foundry operations. Meanwhile, Broadcom, another giant in the AI chip space, and AMD have also shown strong interest in Intel’s 18A process technology.

According to Arcuri, Intel is actively pursuing foundry contracts with Nvidia and Broadcom, with Nvidia’s intent appearing particularly clear and “closer” to incorporating Intel into its supply chain, potentially as a second or third supplier. In contrast, the progress with Broadcom and AMD remains less certain, but the attention from these three major chip design companies underscores the potential of Intel’s 18A process. Arcuri wrote in his report: “Intel is working hard to finalize a deal with Nvidia or Broadcom, which would elevate its foundry’s market position.”

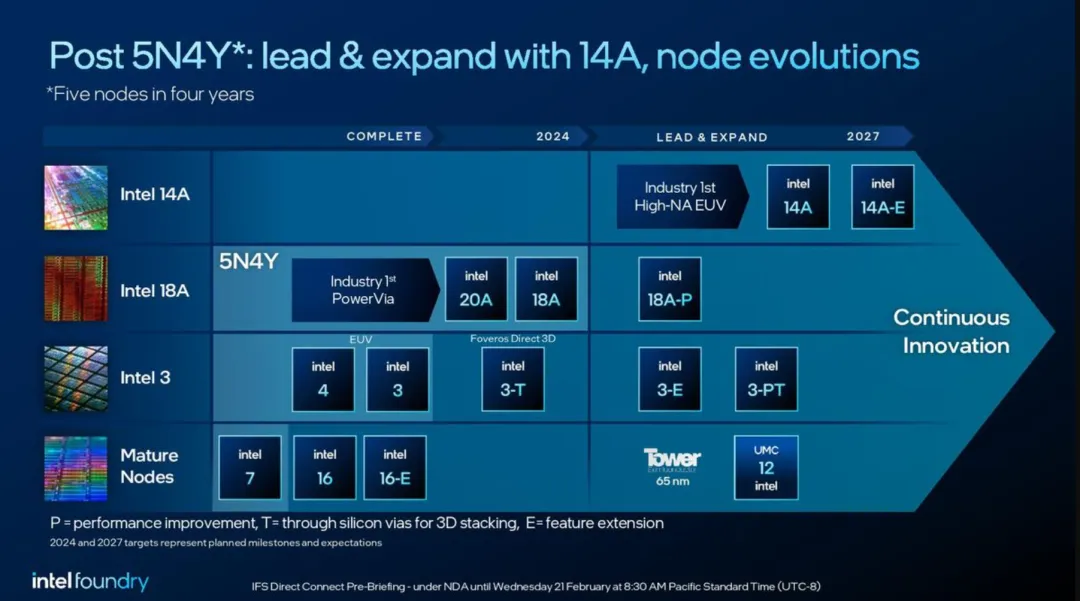

Intel’s 18A process is the focal point of this collaboration. This 1.8-nanometer technology integrates RibbonFET transistor architecture and PowerVia backside power delivery, enhancing chip performance and optimizing energy efficiency. Intel plans to mass-produce its next-generation products using the 18A process in the second half of 2025, including the consumer-oriented Panther Lake processor and the data center-focused Xeon 7 “Clearwater Forest” CPU. Additionally, Intel is developing a performance-enhanced 18A-P variant, which offers either higher performance at the same power level or lower power consumption at the same performance level compared to the standard version. These features are particularly appealing to external clients seeking an optimal balance of performance and efficiency, potentially making it a new option for chip design firms.

For Intel, 18A is not just a technological upgrade but a cornerstone of its foundry business resurgence. In recent years, Intel has accelerated its transformation through the IDM 2.0 strategy, aiming to evolve from a traditional chipmaker into a comprehensive system foundry. In August 2024, Intel announced that Panther Lake and Clearwater Forest had successfully taped out and booted operating systems, signaling smooth progress with the 18A process. The first external customers are expected to complete their design tape-outs in the first half of 2025, with mass production beginning in early 2026. While this timeline lags slightly behind TSMC’s 2nm process (set for production in late 2025), Intel claims that 18A matches or even surpasses TSMC’s 3nm and 2nm technologies in certain performance metrics.

Nvidia’s interest is not unfounded. As the global leader in the GPU market, its gaming GPUs (e.g., the GeForce RTX series) demand cutting-edge manufacturing processes that deliver high performance for gamers while managing power consumption for heat and cost efficiency. Historically, Nvidia has relied primarily on TSMC and Samsung for fabrication, but supply chain diversification has become an industry trend. If Intel’s 18A process meets Nvidia’s requirements, it could alleviate capacity pressure on TSMC and provide Intel with a steady stream of external orders. Market data suggests Nvidia’s GPU shipments in 2024 will exceed 30 million units, and shifting even a portion of that production to Intel would be a win-win for both parties.

Broadcom’s situation is more complex. Known for networking chips and ASICs (application-specific integrated circuits), the company has previously tested Intel’s capabilities, but the results were not entirely satisfactory. Reports indicate that test wafers for 18A delivered to Broadcom by late 2024 fell short of mass-production standards, leading to a cautious stance. However, Intel insists that 18A’s yield and performance are on track, with any issues being normal adjustments during the optimization phase. AMD’s movements are also noteworthy. As Intel’s direct competitor in CPUs and GPUs, AMD relies heavily on TSMC, but a successful test of 18A could further diversify Intel’s foundry customer base.

Intel is internally preparing for this critical moment. New CEO David Zinsner will make his debut at the Intel Vision conference in Las Vegas on March 31, addressing analysts and investors. The event will unveil Zinsner’s plans for Intel’s chip design and foundry businesses. Former CEO Pat Gelsinger heavily championed the 18A process and foundry strategy, a direction maintained by interim co-CEOs. Expectations for Zinsner are high, with many watching to see if he can solidify Intel’s footing in the fiercely competitive foundry market.

In 2024, Intel’s foundry division reported a 13% year-over-year revenue decline to $4.5 billion, with an operating loss of $2.26 billion—nearly double the previous year’s figure. Nevertheless, Intel projects foundry revenue to reach $16.47 billion in 2025 and aims to break even by 2027. To support 18A mass production, Intel is ramping up equipment installation at its Fab 52 facility in Arizona and has secured $1.1 billion in subsidies from the U.S. Department of Commerce, part of a $7.86 billion total under the CHIPS Act.

This potential partnership is not just about the future of Nvidia and Intel—it reflects profound shifts in the global chip supply chain. Whether Intel’s 18A process can deliver on its promises and become a reliable choice for Nvidia, Broadcom, and others will be answered in 2025.